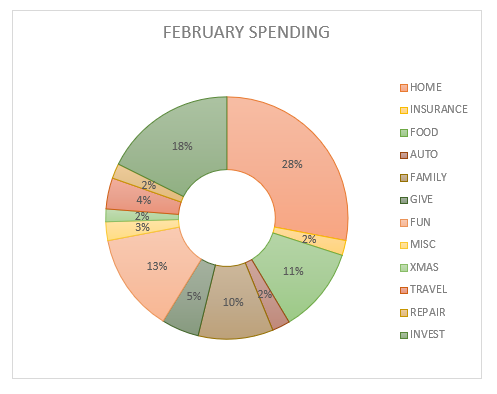

Everything I Spent in February

This year I plan to share with you what we spend in our household each month and why.

Reasons for sharing this with you all are two-fold. 1) It holds me accountable - accountability is a very important pillar of healthy money habits. And 2) it fosters a community of openness and transparency here on my site, which is my goal. If we talk about money, we all grow more comfortable with it. So I’m putting my money where my mouth is... 😏

We are 39/40 year old dual income family with 3 kids ages 13, 11, and 8.

Some expenses will be shown as percentages while others in U.S. dollars.

Pivot Expenses (the unexpected…)

It was the month of repairs… during the subzero temps in January, our hot tub broke. RUDE. So that repair was about $300.

We also took one of our cars to the shop for a full tune-up and maintenance. That was a pricey repair at $700. We used money from our Repair Fund.

Taxes… I had a surprise tax obligation for my business. You won’t find me discussing my business expenses here often because I manage them separately, but I had to dip a little into my personal spending to float it this month. It was an important lesson that while I’m building and learning (and spending more than earning), I need to be more intentional about diligently depositing into my business account until I’m earning a profit.

Planned Expenses

Home: Mortgage + Utilities = 23% of take-home pay

Other than our increased phone bill (thanks, Verizon, for that rate increase right after your class action lawsuit loss), all of our mortgage and utilities were on par with expectations.

Home: Repairs & Services = 4%

We covered the hot tub repair, which we used this budget for; however combined with some other maintenance (HVAC and pest control), this budget was exceeded by a few dollars.

Home: Supplies = 1%

The non-food home spending came in way under budget this month. We’ll take the win.

Home: Subscriptions = <1%

This covers our streaming services, online subscriptions, and our magazine subscription. No surprises, no increases.

Insurance = 2%

This includes our auto and term life insurance policies. Homeowners insurance is in escrow and included in our mortgage payment.

Food = 11%

We came in right at budget for dining out and groceries this month. My husband and I had a fun date night out and kept the fridge and pantry well-stocked all month.

This category is the one that I always feel like we could easily decrease. But through the years I’ve learned that my husband and kids much prefer to have an abundance of food choices in the house versus just enough. So I now put more in the budget than what I want to spend and we are all happier as a result. I know we’re covered and don’t freak out when we spend more than I want, and my family is happier.

Auto: Gas = 2%

Our fuel spending came in slightly under budget for the month. We didn’t travel out of town and took advantage of our local gas station’s discount program and specials every time we refueled.

Family: Kids = 6%

This covers the kids’ pay days, school lunches, field trips, and family activities.

We went a little over on this budget last month, and it wasn’t even really just one thing. A few unexpected little things added up to an overage. Not a big deal, but it was worth us pausing on and evaluating.

Family: Health = 4%

This category includes doctors, dentists, and therapy.

I’ve mentioned this but we always pad this budget by a couple hundred dollars to allow for surprise doctor visits. Fortunately no sicknesses befell the family in February.

That said, our dog had his annual visit to the vet and refilled his full year supply of heart worm meds. That’s always a costly trip, and the health of our best favorite animal is worth every cent. He’s an old dog, embarking on his 12th birthday this year, and fortunately his health is in good shape.

Giving = 5%

We give a portion of our income to organizations we believe in each month. This month we gave to Thistle Farms, an organization dedicated to helping female abuse survivors by providing free housing, healthcare, counseling, and job readiness training. My employer offers a 1:1 match for this donation, which was really cool to learn!

Fun Money = 13% of income

My husband and I each have our own budgets for stuff we love, like, and want. Each one (his & mine) is tight enough that we do have to keep an eye on them but also loose enough that we’re not stressing over every single dollar or discussing every expense.

We had gone a few dollars over our fun money budget in January. So we made up for it in February. I share my fun spend details below because that’s the budget I manage. My husband manages his own and I don’t need to know all the specifics. That’s completely intentional; it keeps me happier not nitpicking his spending, and it keeps him happier when he has freedom with guidelines.

My Fun Spend - Specifics:

Girl Scout Cookies… 😳

Our daughter is a proud Girl Scout and we supported her troop by buying more boxes than I should be comfortable disclosing on the internet. I’ll just say we have enough to last us a while… I put this in my spending category because it makes me happy to buy these for the family to enjoy.

Our middle son turned 11 this month, so we got him a gift he’d been begging for, and since we split the gift & birthdays budget between our two fun spend categories they were planned for and covered.

A few business expenses came out of this spending this month. This isn’t my favorite way to spend this money, but occasionally it’s necessary.

I got a few other little goodies for myself — a kitchen scale for baking, a few items of clothing, and some skincare stuff.

Miscellaneous = 3% of income

Ordinarily I don’t encourage categorizing purchases under miscellaneous, because the category is ambiguous and can be unclear upon review. However, because I had a business tax that created a need to pivot, I logged it here and made a note in the budget to jog my memory later.

Savings & Investments

Short term Savings:

$415 for Vacation Fund

Our next trip is coming up soon. We’re so excited!

$200 for Repair Fund

Saving for that inevitable car trouble or home repair. This fund is crucial for our peace of mind, and came in quite handy in February!

$170 for Christmas 2024

We set aside a bit each month for the most expensive time of the year. This fund has saved us loads of holiday headaches through the years.

$300 for Dream Fund

There was a bit leftover this month after all expenses, giving, and planned investments, so we added it to our Big Dream Fund for our someday home in Florida.

And these funds are all kept in HYSAs, so that saved money earns interest!

Long Term Investments = 18%

$1,166 for 2024 ROTH IRAs (mine + my husband’s).

For those who qualify, the 2024 max ROTH IRA contribution is $7,000, which is $583 each month. My husband and I each have a ROTH account, so $1,166 per month is our plan.

Our 401k (traditional IRA) and HSA investments are taken out of our paychecks before tax.

The leftover bit went toward our kids’ 529 investments for post-high school education. Whether they want to go to college or trade school, we’ll have a chunk of money set aside to help out when that day comes.

That’s it. February books are closed!

We had some expensive repairs, a few surprises, and some normal life expenses last month. We managed through it as a team, and we’re always proud of that.

It’s taken us the better part of a decade to fine tune the numbers and get on the same page with our budget, and while we’re nowhere near perfect, we are making great strides. Budgeting is a marathon not a sprint, so take it easy on yourself if your numbers didn’t add up the way you’d expected. Allow for grace. Reflect, learn, and adjust.

How did your February spending go? Let’s all learn from the mistakes or surprises and celebrate the wins!