Everything I Spent in September

This year I’m sharing what we spend in our household each month and why.

Reasons for sharing this with you all are two-fold.

1) It holds me accountable. Accountability is a very important pillar of healthy money habits.

2) It fosters a community of openness and transparency here on my site, which is my goal. If we talk about money, we all grow more comfortable with it. So I’m putting my money where my mouth is... 😏

We are 40 year old dual income family with 3 kids ages 14, 11, and 9.

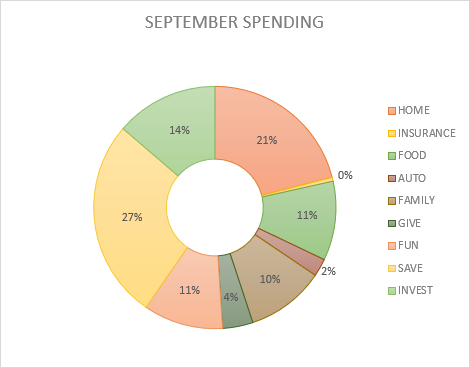

Some expenses will be shown as percentages while others in U.S. dollars.

Pivot Expenses & Surprises (the unexpected…)

For once (for once), we had no unexpected expenses! Sometimes we roll across a lucky month where nothing goes awry. For our household, September was calm and the finances panned out better than expected.

My husband is paid every other week, and September happened to have three paydays for him instead of the usual two. Instead of spending that surplus, we popped 100% of it into our savings. We planned for this, so it’s not necessarily a pivot, just a note.

Planned Expenses

Home: Mortgage + Utilities = 16% of take-home pay

We were under budget, mostly due to our electricity bill clocking in $50 below expectations.

Home: Repairs & Services = <1%

Nothing unexpected in this category this month.

Home: Supplies = 3%

14 chickens cost a bit more to feed than nine did, so we’re spending a bit more on chicken stuff these days. Fortunately this budget had some wiggle room already, so we’ve been able to stay within those parameters.

Home: Subscriptions = 1%

Nothing unexpected in this category this month either.

Insurance = 1%

This is just our life insurance policy. Health insurance is paid before my paycheck gets to me, and our auto policy is now paid just twice a year.

Food = 11%

As opposed to last month, September was not as costly for food. We had one week of “scavenging” (the overly dramatic expression we use when we work through freezer and pantry food and skip a grocery trip), a few days of vacation where we used our vacation savings fund for dining out, while balancing with some indulgences and the usual fare.

Auto: Gas = 2%

Our gas spend came in $70 under budget! Again, this is likely due to using vacation funds for our big road trip.

Family: Kids = 9%

Braces, pay days, and the monthly saxophone payments (12 months same as cash) are now budgeted here. This budget line is a hefty one now, but we spent just what we expected.

Family: Health = 2%

Counseling and the usual expenses were covered here, and we were under budget.

Giving = 4%

This month we gave to a relief fund for Hurricane Helene. When the hurricane made landfall on Sept 26, we had departed our favorite Florida vacation spot just a few days prior. It breaks our hearts for residents of the Sunshine State, Appalachia, and all those throughout the southeast who were impacted by the devastating storm.

Fun Money = 11% of spending

My husband and I each have our own guilt-free budgets for stuff we want. Each one (his & mine) is tight enough that we do have to keep an eye on them but also loose enough that we’re not stressing over every single dollar or discussing every expense. It’s a good balance for us.

My Fun Spend - Specifics:

I splurged for a couple gifts for others and set aside some cash in my business account for next month’s business renewal expenses.

Savings & Investments

Short term Savings:

$415 for Vacation Fund - gotta refill after our big anniversary trip!

$200 for Repair Fund

$170 for Christmas 2024

We set aside a bit each month for the most expensive time of the year. This fund has saved us loads of holiday headaches through the years.

We also socked away a few thousand bucks in our Big Dream fund!

All these funds are all kept in HYSAs, so that saved money earns interest!

Long Term Investments = 14%

$1,166 for 2024 ROTH IRAs (mine + my husband’s).

{For those who qualify, the 2024 max ROTH IRA contribution is $7,000, which is $583 each month. My husband and I each have a ROTH account, so $1,166 per month is our plan.}

Our 401k (traditional IRA) and HSA investments are taken out of our paychecks before tax.

The rest of those investment dollars went toward our kids’ 529 investments for post-high school education.

That’s it. September is done!

Please remember — It has taken us a decade of ups and downs to get on the same page with our budget, and while we’re nowhere near perfect (as you’ve likely observed, we have to pivot somewhere almost every month), we are making steady progress and keeping our overall direction on track.

Budgeting is a marathon not a sprint, so take it easy on yourself if your numbers didn’t add up the way you’d expected. Allow for grace. Reflect, learn, and adjust.

How did your September spending go? Let’s all learn from the surprises and celebrate the wins!